Start-Up Tool Company Takes on Giants

Delta, WMH veterans break away to form Steel City Tool Works

June 1, 2006

MURFREESBORO, TN.–Reversing the recent trend of mergers and acquisitions in the tool industry, a new manufacturer called Steel City Tool Works was launched today by former executives, product managers, and sales people from major machinery manufacturers, including Delta and WMH Tool Group.

The company said it hopes to succeed in the crowded marketplace by maintaining a singular focus on the dedicated woodworker.

“There’s a great void in the marketplace right now and the players that are out there have really lost sight of the end users,” said Scott Box, vice president and general manager of Steel City Tool Works.

To this end, Steel City is bypassing the big-box stores and Internet clearinghouses in favor of set prices and a limited network of regional dealers, the company said. By selling its tools through select licensed retailers, the company plans to reach customers with a team of knowledgeable resellers and focus on customer relationships. A five-year warrantee will be standard.

“We feel we can offer good solid products with strong features at a fair price through selective distribution,” Box said. “We have to have a strong relationship with our distributors, who we know have a strong relationship with our customers.”

Industry experience

Box is one of two partners who have put their own retirement savings on the line to launch the company. The other is Mark Strahler, who first met Box at Delta-Rockwell in 1979.

Most recently Box was president of Powermatic and vice president of its parent company, WMH Tool Group, which also owns the Jet, Performax, and Wilton brands. Strahler left Delta in 1999 to form Orion Tools, a private-label company that manufactures the well-reviewed new line of Craftsman tablesaws. Those designs are included in the Steel City tool line, and Orion will stay intact as a subsidiary of Steel City Tool Works.

Most of the company’s executives and employees also come from the woodworking tool industry and contributed to the designs of many of the standard woodworking tools on the market today.

Diverse tool line focuses on the woodshop Steel City Tool Works will focus on serious woodworking equipment — jointers, tablesaws, and the like — with benchtop tools limited to a portable planer, a hollow-chisel mortiser, and a few bench grinders. To keep prices competitive, manufacturing will take place in Asia, where the Steel City staff has many decades of cumulative experience.

Steel City Tool Works will focus on serious woodworking equipment — jointers, tablesaws, and the like — with benchtop tools limited to a portable planer, a hollow-chisel mortiser, and a few bench grinders. To keep prices competitive, manufacturing will take place in Asia, where the Steel City staff has many decades of cumulative experience.

The company’s initial 31-machine line is already in stateside warehouses and should be in showrooms around the U.S. and Canada by August, the company said.

“We’re avoiding the trap of bringing miscellaneous ‘stuff’ to the marketplace,” Strahler said. “That’s why we are introducing one drill press, not 12. Overloading the marketplace is both wasteful [for Steel City] and confusing for the end-user.”

Plans for innovation Most of the innovation so far at Steel City is in the business plan, not tool development. In order to get a full line to market at launch, the partners said they had to delay some of their plans for new features. Their initial product line will include standard tool designs where the patents have run out.

Most of the innovation so far at Steel City is in the business plan, not tool development. In order to get a full line to market at launch, the partners said they had to delay some of their plans for new features. Their initial product line will include standard tool designs where the patents have run out.

There have been a few product improvements, however. Cast-iron tablesaw trunnions and welded steel bandsaw frames have been beefed up, dust ports and fences have been redesigned, and washable 1-micron bags are standard on dust collectors. The tools are also highly adjustable. For example, the company’s bandsaw wheels can be adjusted in every plane.

Steel City’s first attempt to grab headlines is a rust-free saw table that is coated with titanium-nitrite, the bronze-colored coating seen on some drill bits and saw blades. With a surface hardness greater than carbide and just short of diamond, it is designed to eliminate maintenance, the company said.

Steel City’s tablesaw will come with a traditional splitter and blade guard rather than a riving knife found on new tablesaws from Powermatic and SawStop, which own patents on those devices. Steel City executives said they are planning to create their own patented riving-knife system in the next few years.

Steel City’s tablesaw will come with a traditional splitter and blade guard rather than a riving knife found on new tablesaws from Powermatic and SawStop, which own patents on those devices. Steel City executives said they are planning to create their own patented riving-knife system in the next few years.

“We’ve got three more tablesaws in the works right now,” Box said. “We’re looking very closely at how we can offer the safest possible product through our new designs.”

A changing market

The power tool industry has seen a flurry of consolidations in the past few years. In 2004, Black & Decker Corp. finalized its acquisition of Pentair Inc., taking over the Porter-Cable, Delta, DeVilbiss Air Power, and Oldham Saw brands.

Techtronic Industries, which launched the Ridgid brand in 2003, acquired Milwaukee in 2005 and has owned the license to the Ryobi brand since 2000. And in 2002, the WMH Tool Group reorganized to include the Jet, Powermatic, Performax and Wilton brands.

Amid this change, the power tool market continues to show signs of growth. Sales of power tools in the U.S. topped $8.6 billion in 2005, according to industry estimates.

“We’ve probably got another 10 or 11 years where the boomers are going to be buying tools,” said Box. “At that point, it will be our job to identify the next generation of tool buyers.”

Discuss this article in the Knots forum.

Asa Christiana is editor of Fine Woodworking magazine.

Fine Woodworking Recommended Products

Veritas Precision Square

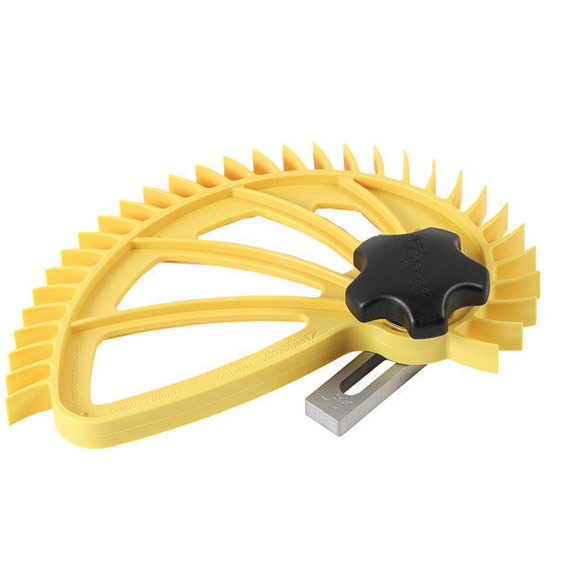

Hedgehog featherboards

Ridgid R4331 Planer

Log in or create an account to post a comment.

Sign up Log in